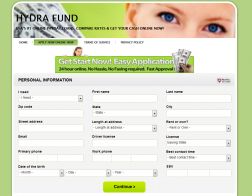

Hydra Fund

Queja 130480 Detalles

- Fecha cuando ocurrió 03/13/2014

- Daños Reportados: $776.00

The complaint is against an online dating profile

The complaint is a listing fraud posted on public forums or sites against an anonymous entity

The complaint is mobile text spam or smishing related against an anonymous entity

The company or person contact no longer exists

International boundaries

In early March of this year I was researching personal, long-term, low interest loan options on-line. I found none of the results I qualified for to my liking-the interest was either too high, or the amount too small, to be of any real use for what I intended. At the time, I had two accounts open with Navy Federal Credit Union: a savings account with a minimal amount, as well as a checking account I had just opened with a zero balance. I used the checking account information while researching these loans. Since I did not continue the application process with any, I assumed over the next months that the account remained empty and continued to use my prepaid Visa card rather than fuddle with going through a third party branch to deposit money into a bank that-while fantastic-does not have any local branches. I did not check into my checking account until May, when I happened to come across a strange e-mail in my junk folder stating that it was a reminder of an automatic withdrawal from my checking account. I checked the e-mail, and saw that it had all of my account information on it, and was indeed an invoice for a series of debits from my account, and another scheduled for $93 that day. I e-mailed back to ask what this pertained to-I had accepted no loan application. She replied that the loan amount had been deposited into my account on March 13. While this was going on, I called my bank and asked what I should do. I explained the entire situation, how I researched loans from several different sources online but completed none of the applications and accepted none finally. Her advice was to close my checking account, open a new one before anything else could be withdrawn (the amount deposited from THREE different companies operating under the same M.O. totaled $800, of which $776 had already been withdrawn, with another $300 due in interest according to the "invoice" I had been sent) and bounce the account. She then directed me to the "Unauthorized Debit/Credit" form, which I completed and faxed back that day detailing the unauthorized transactions performed on my account.

Earlier this month, I received a call from a supposed law firm calling on behalf of Hydra Fund/Tior Capital LLC/pdloans.com stating that a summons was going to be issued for me in my county in a suit for $746 from these companies for the interest owed on this loan that I did not authorize, as well as for the "bounced" payments as they continued to try and withdraw from the closed account (I forgot to mention that I did notify the customer service rep who e-mailed me that I WAS closing that account, and I was NOT going to pay interest on a loan I did not accept-the loan amount had been received back shy $23, I was neither aware of its presence in my account and nor did I use any of the funds-yet they still continued to try and take payment?). I told them the situation with the company, the action I had taken on the advice of my bank, and that I owed this company nothing. I was coldly told that my bank and e-mail records had been subpoenaed, that they were suing me for that amount and court costs, etc. I panicked. I've never experienced anything like this, and I certainly never thought I would. They offered to settle out of court for $50 out of every pay period of mine until I paid off the amount in December. I agreed in haste, as my work schedule does not exactly leave much time off and I above all do not want any conflict with my job. The woman took my prepaid debit card information so they could withdraw the money automatically (I had to give her my pay dates as well). After that call, however, I called my bank and spoke with a specialist, and told them the whole story. She made sure I had not given any of my personal account information to them, and then did some research for me. All three companies made deposits, and all three made withdrawals at differing amounts and dates, but roughly they pulled out $70-$93 every week until, as already stated, the entire amount had been received back. She could also see where I had filed my complaint against the companies with them, and that no action had been taken to seize the records of my account. She looked the companies up online, and saw HUNDREDS of cases just like mine reported. She advised me to contact the BBB, the Attorney General, and to NOT pay them any money. I have taken her advise. On the 25th, I received a call from the "law firm" (the name sounded like "Robert Green and Associates", but she would not repeat herself or give any other information) saying that if I did not pay the "agreed upon" amount they would release my case for processing in my county. I said I did not consider the agreement valid as it was made under duress and false information--I said as much in the other complaints I filed--and left it at that.

The BBB cannot get in touch with this company-I have had no luck either. It seems as if they are solely an internet based web of scammers. I cannot find any solid contact or website information; they work through a mask of third party websites, like the ones I visited. I made a bad decision by entrusting my account information to whomever, but I simply could not imagine that they could deposit and withdrawal anything without my completion of the applications. Now, they may sue me? For something I neither wanted or used? I don't want anything from them other than to leave me alone, and to not pay the interest on something done without my knowledge or consent.

- abbyv SBID #4f0940515f

- Publicado 06/28/2014

Comentarios

No hay comentarios publicados. Sea el primero en comentar sobre esta queja

¿Tiene una queja?

Añadir una queja y correr la voz. Quejas de alto volumen tienen una mejor oportunidad para recuperar su dinero. Presentar un informe y unir fuerzas con otras personas como usted!

Presente Una Queja AhoraResumen del Perfil de la Empresa

EstadÌsticas de la Empresa

- Queja Contra Hydra Fund

- Quejas Presentadas: 914

- Daños Reportados: $412,667.81

What is SBID?

SBID is a unique id code that identifies the user's computer and location. SBID is used to prevent fraudulent postings and help our community find users who create duplicate user accounts.